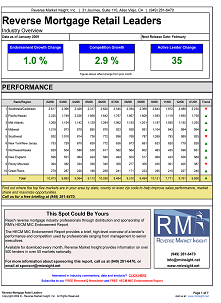

We’ve known for some time now that Wells Fargo’s endorsement numbers would drop dramatically as we headed toward the end of the year – now we have our first month’s view of the industry ex Wells.

HECM endorsements for October were down -16.8% to 4,653, the lowest total since the industry bottomed out in May 2010 from the first principal limit reductions. Wells Fargo wasn’t totally absent from October’s endorsements, with 787 loans still good for second place behind Metlife, but that’s probably more bad news than good.

We’re almost sure to break last year’s bottom next month as Wells volume declines further, and if other lenders can’t pick up some of the loans Wells isn’t doing, we could be looking all the way back to July 2005 for the last time monthly endorsements were under 4,000.

What is more surprising than the Wells decline, which has been expected, is the relative weakness of several other lenders in the month. Metlife, Urban, Generation, and Security One all declined in October. The aggregate decline of these 5 lenders is slightly larger than the total industry decline, while One Reverse, Genworth, AAG and Reverse Mortgage USA helped stem the tide.

These numbers include TPO business under the new HUD system, so we’ll have a better read for retail/broker/TPO trends next month when we can dissect further in our HECM Originators report. For now, we can simply observe that so far, the industry does not seem to be making up for the branch distribution network losses of BofA and Wells.

Click on the image below for this month’s report.