Maximize Efficiency.

Be First to Seize Loan Opportunities

RMI gives retail originators the HECM data and analytics tools you need to instantly see trends and opportunities in the reverse mortgage industry, analyze your own sales performance against competitors, and confidently make informed reverse mortgage marketing decisions.

Products

The HECM Neighborhood Widget

Puts local reverse mortgage data from our Scorecard tool right on your website so you can:

Watch our introductory video

Increase engagement on your site with an interactive tool that:

- Shows visitors how popular reverse mortgages are with their neighbors with local reverse mortgage data

- Keeps them on your site long enough to learn what you’re currently offering

- Helps them easily request more information

Turn engagement into leads by:

- Branding your widget with your colors, language, photograph, and contact info

- Linking directly to your sales

The Retail Dashboard

The Answers You Need Right In Front Of You

CORE TOOLS

Snapshot

Provides a high-level overview of competition and HECM endorsement analytics in multiple markets across the country at the state or county level so lenders can :

- Improve marketing and sales efficiency nationwide

- Coordinate complex territory assignments

- Target recruiting efforts to maximize coverage

Scorecard

Lets originators zoom into HECM reports by zip code to see exactly where loans are happening wherever you have an office, or even an individual loan officer. The Scorecard Tool lets you draw a radius around that physical presence and reveal the best places to invest your marketing and sales resources:

- See exactly where the competitors you currently beat are opening

- Know where the most loans are being originated overall

- Earn more loans in every top HECM county, HECM city and HECM zip code near you

Market Opportunity

Shows reverse mortgage data for an entire state down to the local level. You can easily see HECM endorsement reports by market with HECM stat details including volume, market share, average Maximum Claim Amount and market size for every state in which you operate so you can:

- Maximize the return on every marketing dollar spent

- Get more meaningful message in front of the right audiences the first time

- Target more borrowers and recruit top talent

OPTIONAL TOOL

Origination Summary

Gives you an immediate overview of any company in the mortgage industry:

- See the business they’re doing by geography, volume, channel and product type

- Know if they are originating their own loans and who they are selling to

- Use integrated API to search Google, Facebook and LinkedIn at once to display company trade names, contact information, websites and social media accounts

PRICING PLATFORM

Maximize revenue, compare investor rate sheets, and see pricing including full HMBS valuation

Now you can quickly compare rate sheets from multiple investors and find the ideal loan for both your borrowers and yourself. Easily balance rates and cash income from various margins

The Pricing Platform includes three integrated functions in one powerful solution

Rate Sheet Comparison has never been easier or more automated:

- Take any group of rate sheets and drag and drop to upload

- See multiple rate sheets in one window

- Easily compare loans by key criteria: price, margin/rate, and utilization

Rate Sheet Generation and Distribution is all in one place:

- Upload multiple rate sheets and compare to determine what the market is doing

- Create internal and external rate sheets that protect your margin

- Automatically distribute, specifying who gets which sheet, all in one system with audit tracking

Full HMBS Valuation puts you in control:

- Compare and generate rate sheets that include crucial Valuation Engine data

- Choose to match market pricing; or

- Use full HMBS Value to determine the price of the loans you buy and sell

- Create your own rate sheets based on your criteria

- Automatically distribute to any audience you determine

Choose How Deep To Dive Info

Comprehensive Reverse Market Data

| Generating Leads (Widget Only) | Choosing Core Dashboard (Snapshot, Market Opportunity, Scorecard which includes Widget) | Looking to Grow (Add Origination Summary) | Taking Control (Add Pricing Platform) | |

|---|---|---|---|---|

| Engage potential customers on your website | ||||

| Convert website visitors into your lead funnel | ||||

| Know where reverse loans are most popular | ||||

| See exactly where your competition is strongest and weakest | ||||

| Get more meaningful messages in front of the right audiences the first time | ||||

| Target more borrowers | ||||

| Recruit top talent | ||||

| Search Google, Facebook, and LinkedIn with one click API integrations to find contact information, websites, and social media accounts | ||||

| See the business a company is doing by geography, volume, channel, product type | ||||

| Create internal rate sheets for loan officers or net branches | ||||

| Upload investor rate sheets and set custom profit margins |

Have a Question Or Want to Learn More?

Learn “How to Supercharge your Reverse Mortgage Marketing”

RMI’s latest ebook gives you step-by-step instructions for localizing your marketing efforts using our timely and accurate market data.

"*" indicates required fields

Technical Requirements

and Pricing

It’s Simpler in the Cloud

RMI software and data are maintained, updated regularly and stored securely on our servers. All you need to access your tools are a web browser and a subscription

Monthly subscriptions and feature selections can be customized to your team’s specific needs.

Contact us to lean more

Services

Use our Simple, Secure and Proven Process.

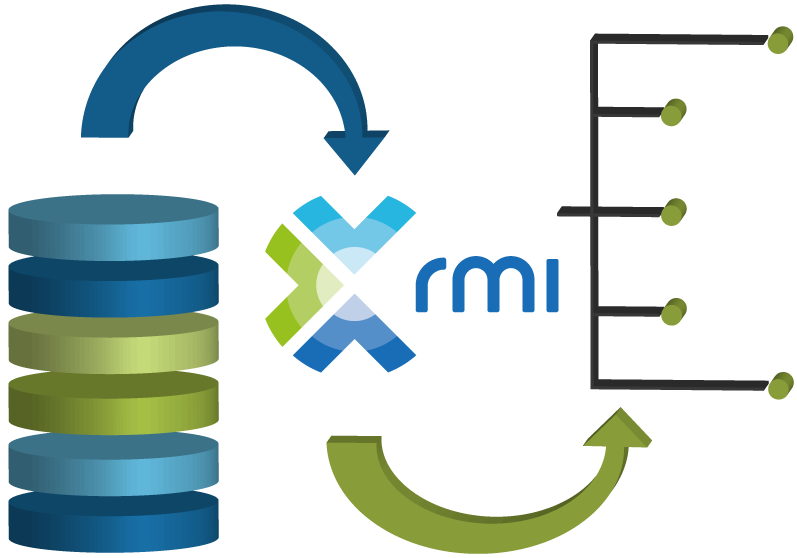

API Integration

Put Our Data Inside Your Tools

You can access the most accurate and comprehensive database in the industry, and pull our individual data sets into your own tools to maximize your sales and marketing performance:

- Add sales and volume detail to your customer-facing forms and sales funnel. Retail lenders use the API to integrate RMI’s reverse mortgage household and volume data into origination tools.

- Perform complex analysis and reporting in your internal applications. Wholesale lenders use the API to integrate RMI’s wholesale volume data directly into their CRM tools to give AE’s fast and easy access to volume trends and customer capture rates.

Make Better Decisions with Better Data

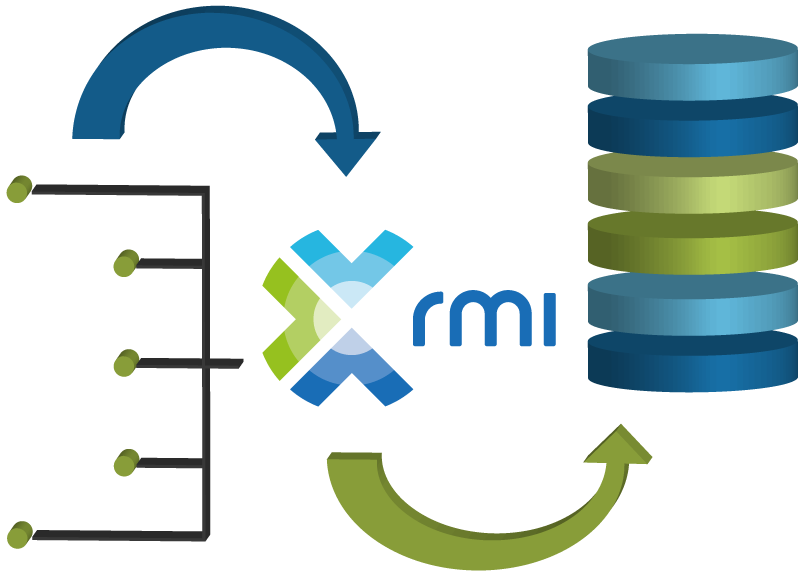

The RMI Data Repository

Your Data Helps Secure The Future

Access to accurate, comprehensive reverse mortgage performance data is critical for making better business decisions, and we need incontrovertible data to show regulators and consumers that we are all part of the financial solution for seniors.

- We’ve partnered with leading technology providers to make sharing information in the repository as easy as clicking a few buttons

- Information collected is similar to current investor/regulatory reporting (HMBS, Fannie Mae, FHA, etc.) so there is minimal data design needed.

- Our datasets don’t require sensitive customer information, eliminating GLBA Privacy Act concerns and substantially reducing risk to lenders.

Be Part of the Solution

Learn How to Add to the Repository