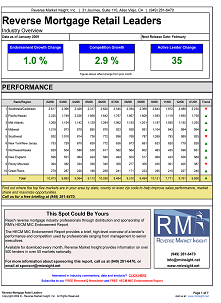

March was more than just the end of the first quarter for the reverse mortgage industry, as it marked the first time since July 2009 that the industry grew from last year. March endorsements came in at 7,306, up 25.5% from last year and up 5.8% from last month.

It takes more than one month to change the tone of our industry, but we’ve been on the long road back for almost a year now since the May 2010 low point for endorsements. And while the majority of industry declines were clearly related to principal limit cuts in October 2009, it’s worth noting that other factors started the decline before that as housing markets and interest rates took their toll.

We also saw further reduction in the number of active lenders, down -9.3% from last month. It was also very encouraging to see the market up across the country. With national volume up 5.8% it would be easy to see some areas of the country lagging behind, but 8 of the 10 regions we track were up from last month and the 2 that didn’t grow declined by a total of 5 loans combined. For comparison, last month’s larger increase of 6.8% saw 3 of the 10 regions decline by a total of 67 loans.

In contrast to the broad strength geographically, we saw half the top 10 lenders decline from February. This might suggest that when we see more detailed results in our Wholesale Leaders report next month that smaller lenders and brokers were responsible for more of the growth in March. A very positive report for the industry overall and a good point of discussion for the upcoming report next month. Stay tuned!

Click on the image below for this month’s report.