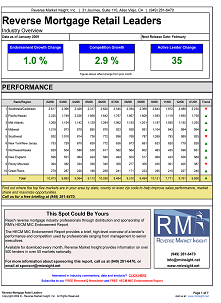

HECM endorsements declined -6.9% in February after a surge in January, but stayed well above the average for the prior 11 months at 4,833 loans.

Some regions of the country were more affected than others by the small decline, while others broke the trend to increase from January:

- Midwest, Pacific/Hawaii and Great Plains all saw new 12 month highs, growing 11.3%, 10.5% and 8.2% respectively

- Rocky Mountain showed the biggest drop, down -23% afer surging to a new high last month

- All other regions declined -6.9% to -14.4%

Total industry volume is down -5.5% compared to the first two months last year, but there are still regions and metro areas showing growth:

- Southeast/Caribbean is up 2.6% from last year, with all metros outside of Florida and Caribbean showing positive growth

- Jackson, Memphis and Louisville are particularly strong – all growing more than 20%

- Pacific/Hawaii is also growing in several places, especially Arizona and other areas that were hit harder by the housing price crash

- Vegas is still taking it on the chin, but inland CA regions like Fresno and Sacramento are coming back as home prices stabilize

Several lenders have also seen good starts to the year:

- Liberty Home Equity officially took the top lender spot on a trailing twelve month basis, despite a decline from last month and their year to date volume is up 40%

- Security One Lending continues to see big gains that might be a good proxy for their growth from Metlife team additions, up 197% year to date

- American Advisors Group is up 124% year to date to round out the top 3

HECM Originators and HECM Trends are expected back shortly, hopefully this month. Cross your fingers that doesn’t fall to the sequestration ax!